MENU (Click on the option) : * Trade Logic * Buy Low & Sell High * Trading Strategy example * GBPUSD Example * GBPJPY Example * 4 Strategy Components * Regular settings * US Account settings * Optimized Settings * Alternative setting technique * Guide settings * Setting Tips and Tricks * Support * Owners Forum * Currency Selection * BELL Videos * Licensing * Prop Trading * Purchasing information * PURCHASE HERE

BENEFITS: * US Broker Version * Tradable on a $1000 * Based on sound Logic * Special Launch prices and bundles

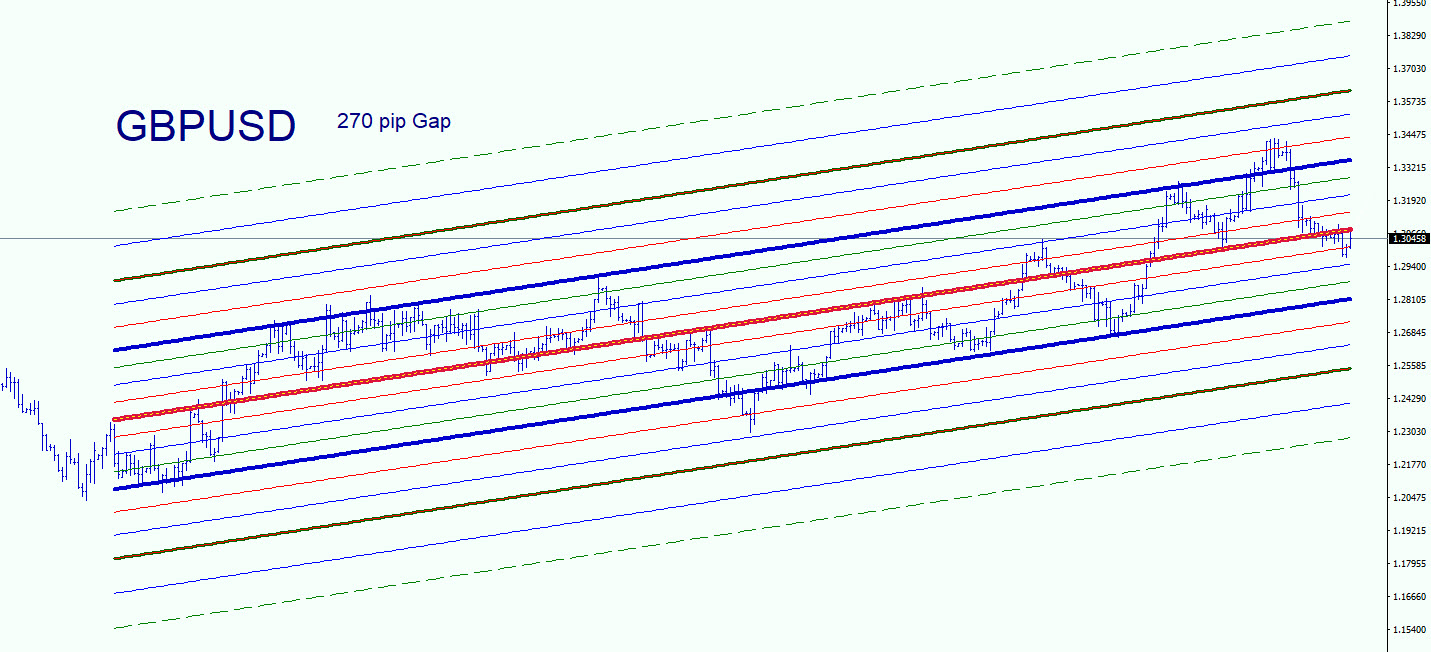

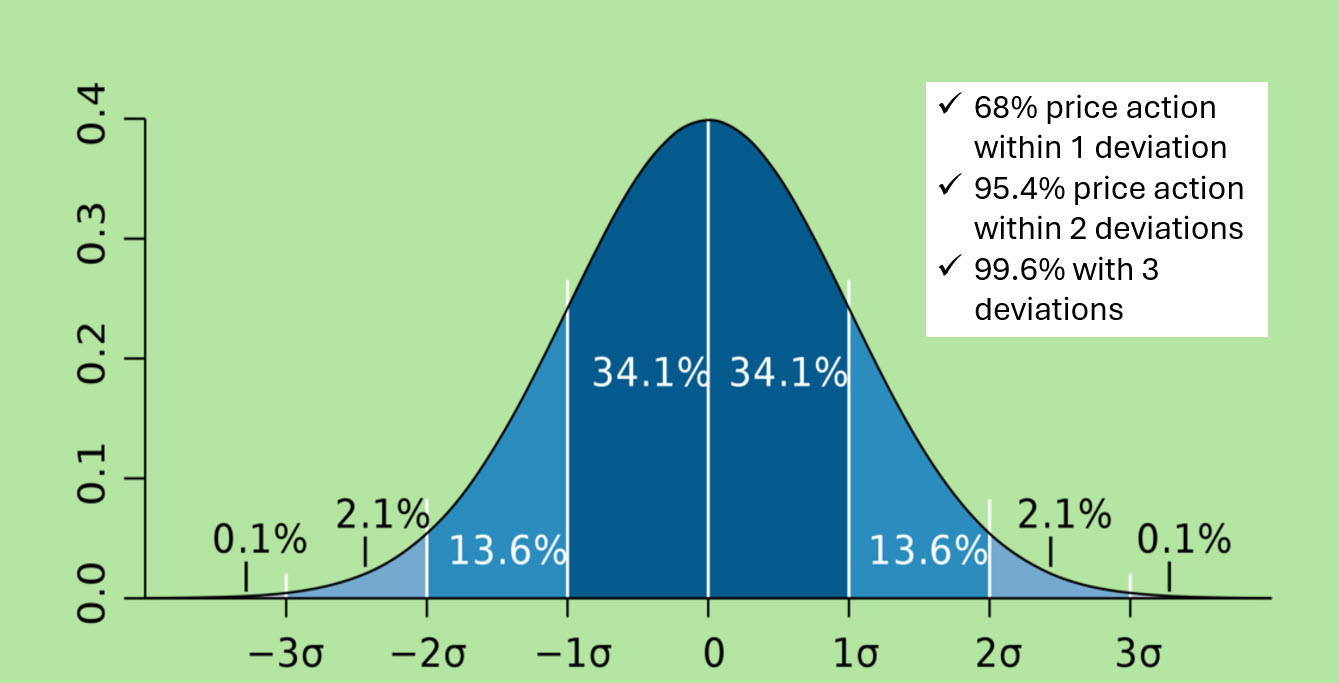

The Bell trader gets it name from a statistical representation of the odds of many readings varying from a statistical average of, in the case of Forex price action, price movements.

Because you are working with an average it makes sense that 50% of the price movement will be above the average and 50% will below the average

Looking back over history the Standard Deviation channels can determine 3 deviations from the average based on the fact that 99.6% of Price action will happen within 3 deviations from the average upward and downwards.

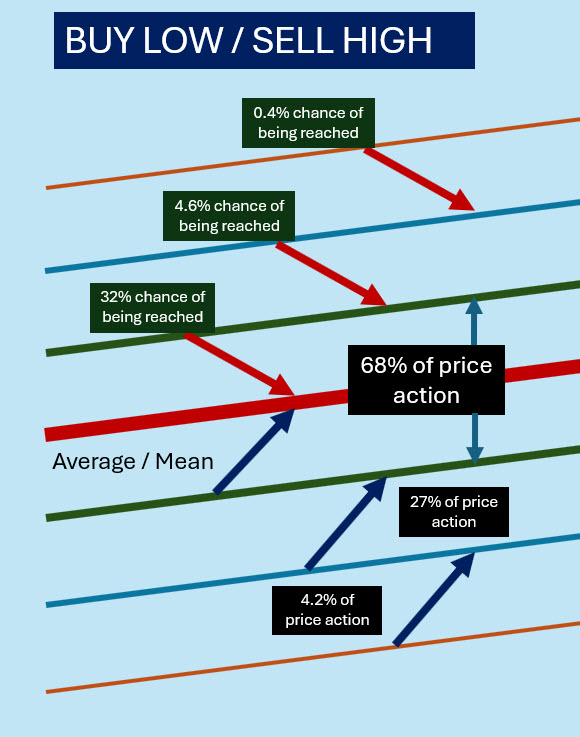

THE BELL TRADER BUYS LOW & SELLS HIGH

The BELL Trader encourages the buying low and Selling high approach as it does not trade when the price is at the average levels.

It only trades back to the average line when it reaches deviation lines as show in the illustration on the left.

The calculated chances of the price reaching the other levels (Based on past history) add an element of safety to this technique

Using increased lot sizing at the outer deviation lines is encouraged buy the prices tendency to move back to the average

Having many trading levels near the average line and fewer at the outer levels tips the odds to the traders advantage

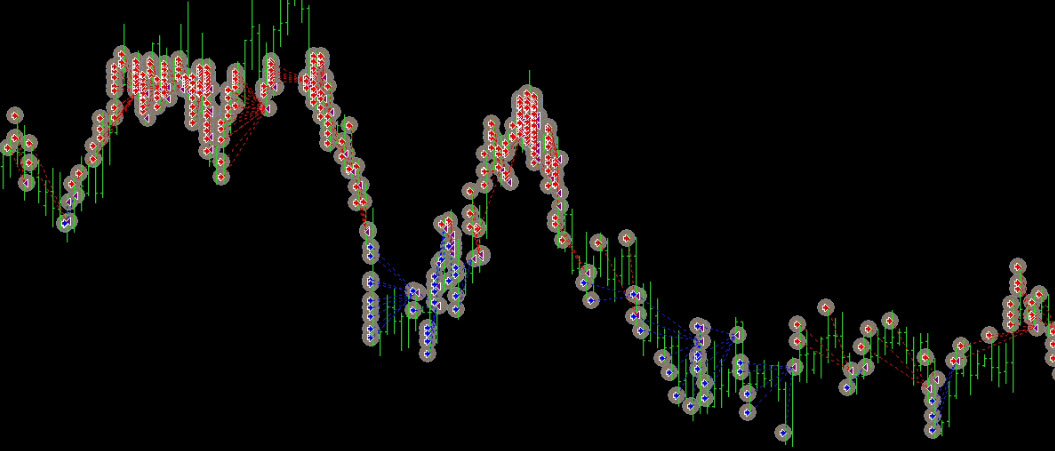

Sounds very complicated? Don't worry. In the end the BELL technique helps you Sell High and Buy Low (SHBL) most of the time as shown in the chart with recorded trades.

And in the end when it gets the direction wrong, it closes baskets of open trades at a profit.

An Example of a trading strategy

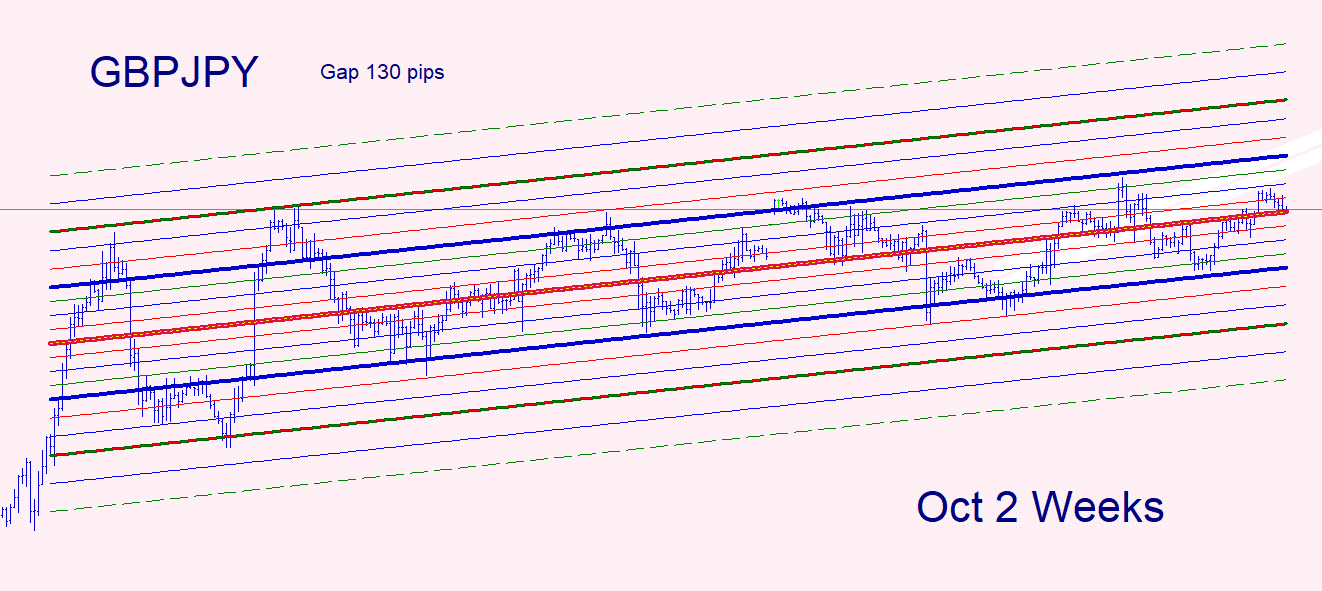

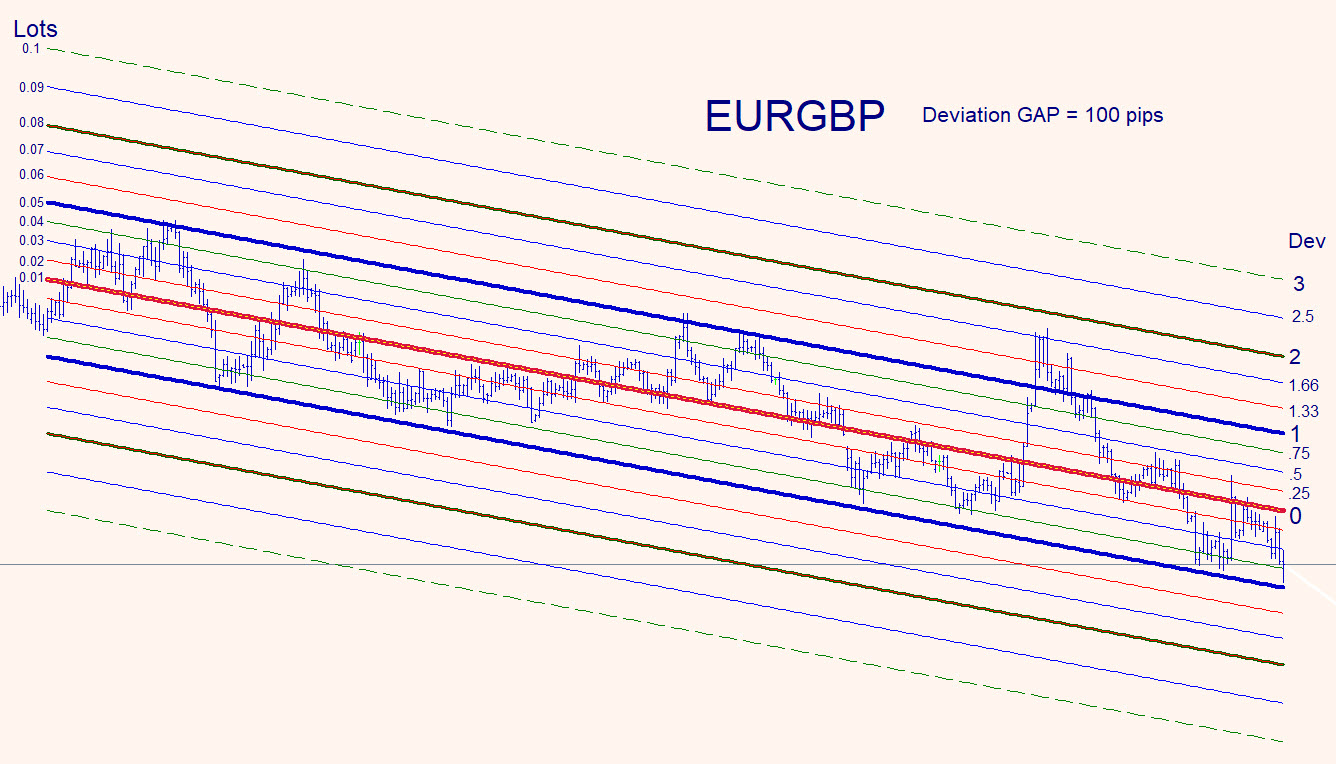

In the example below we see a 12 month Standard Deviation Channel for the EURGBP showing the middle line (Average line, Mean line or the spine) of the price action with 3 deviation lines above and below the Average line. Note that the GAP between major deviation line is 100 Pip in this example.

It shows an example of a possible strategy where the trader has decided to divide the 1st deviation area into 4 sub sections, the 2nd deviation into 3 sub sections and the 3rd deviation area into only 2 sub sections. The are more sub sections near the average line because more price action occurs near the Average line than far away.

In this example, the trader has decided to increase the initial lot size of 0.01 at the average line by 0.01 for every new level away from the average line. This is due to the fact that the chances of the price returning to the average is higher the more the price moves away from the average

The Trading Strategy

- No trading from the average line

- When the price reaches the next standard deviation line, a trade is entered into back to the average line. The Average line becomes the target in this case.

- When the price does not go back to the average line but continues to the next deviation line another trade is opened. Both these trades are then regarded as a basket of trades.

- The target for the basket of trades is decided by the trader but is generally equal or greater than the profit that would be made if the initial trade were successful in dollars. So gains are made when the price continues.

- When the basket target is reached all open trades are closed (using FIFO principles) and normal trading rules apply.

- There is never a duplicate trade at a deviation level (one trade per deviation level)

The Video on the right shows the 4 main components of the Bell Trader Strategies

(Please watch this before viewing the settings)

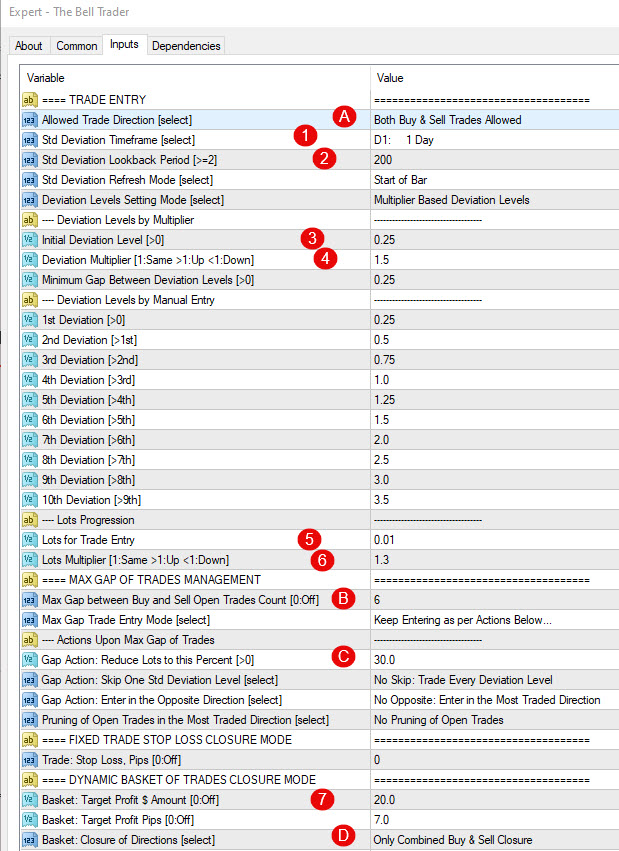

There are only 7 major settings you need to deal with when trading the Bell Trader.

- You need to tell how far you want to look back to create your Standard Deviation Trading area. In general, the longer the more robust and the shorter the risker. To do that you need to specify the timeframe and the number of bars to look back. Settings 1 and 2 on the left.

- You need to tell it the first deviation level from the average line to treat as your first transaction line. Setting 3 on the left

- You then to tell the EA by how much to increase the deviation size as the price moves away from the Average Line. Setting 4 on the left.

- Next is the Lot size for trade entry. If you do not have experience in this area use 0.01 lots and slowly increase that as you gain experience. Setting 5 on the left.

- You can increase the lot size every time the price reaches a new deviation trading level. Setting 6 on the left.

- Then lastly, you need to tell the Robot at what $ level you want to close baskets of trades (when there is more than 1 open trade). Setting 7 on the left.

The other settings can basically be ignored or you can use the default settings.

Please use the user manual available from this link for more information and examples about all the settings.

USER MANUAL

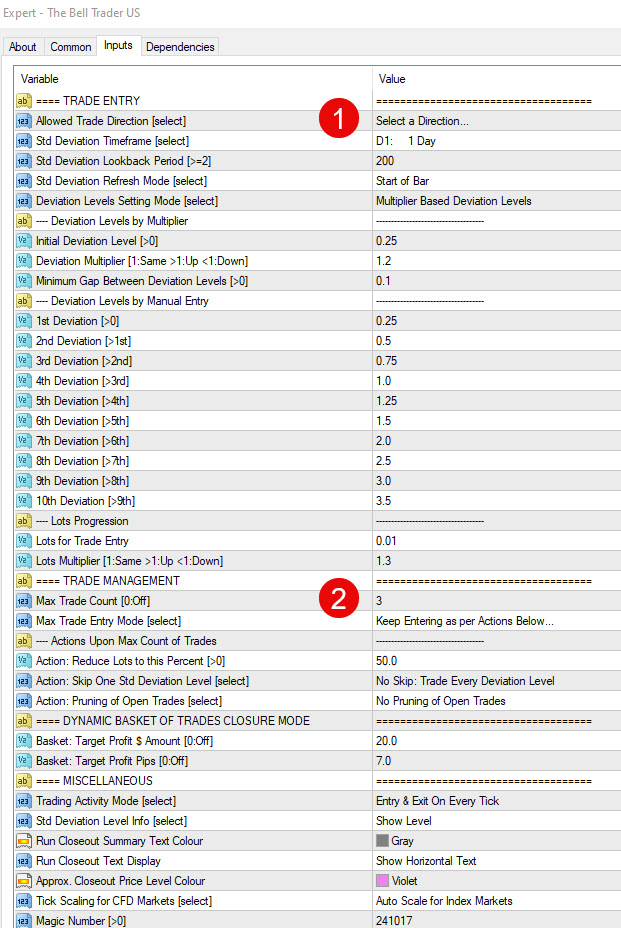

How can US Traders trade the BELL TRADER?

We created a special US compatible version of the BELL trader which is tradeable on US Broker Accounts.

- All non compatible settings have been removed from the regular version so that the US version will have no guess work.

- In order to trade the Bell Trader properly traders should trade Sell only in one trading account and Buy only in another trading account. Setting 1 shown.

- There is a separate Trade Management section for US Broker Accounts which refers to open trades. Setting 2 shown

- FIFO will be adhered to so that when Basket Trades are closed, they will be closed at the same time and in FIFO order

- The normal guide settings can be used as provided, as long as only one direction is traded per US trading account

- Care must be taken as settings assume 100:1 leverage. When lower leverage is used please decrease the lot sizing by between 50% and 30% and lower the basket targets by the same percentage

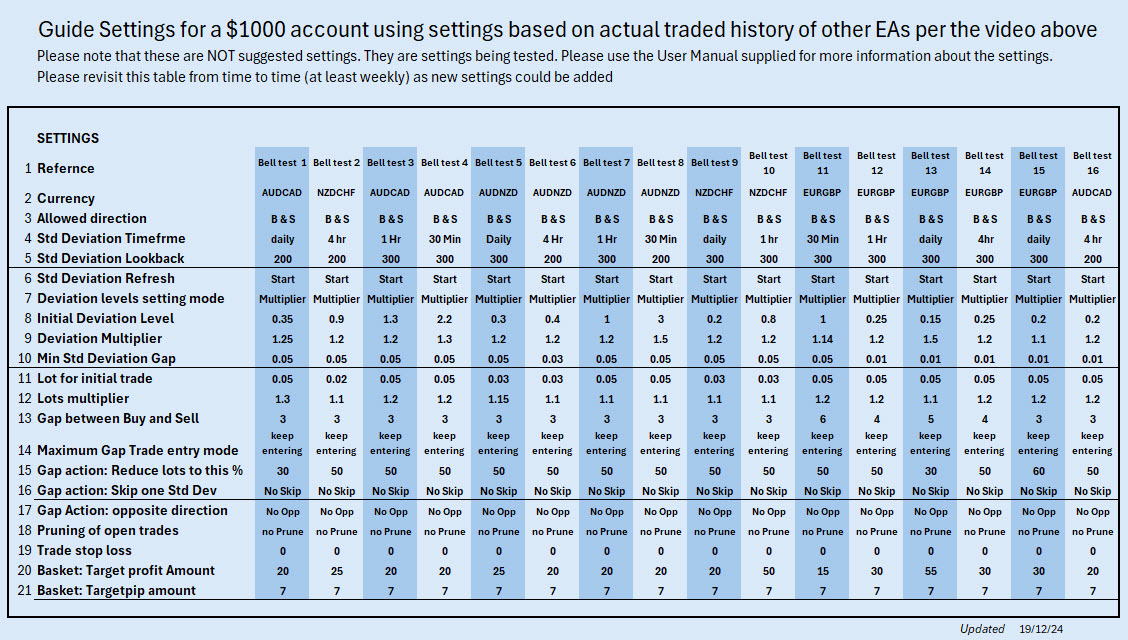

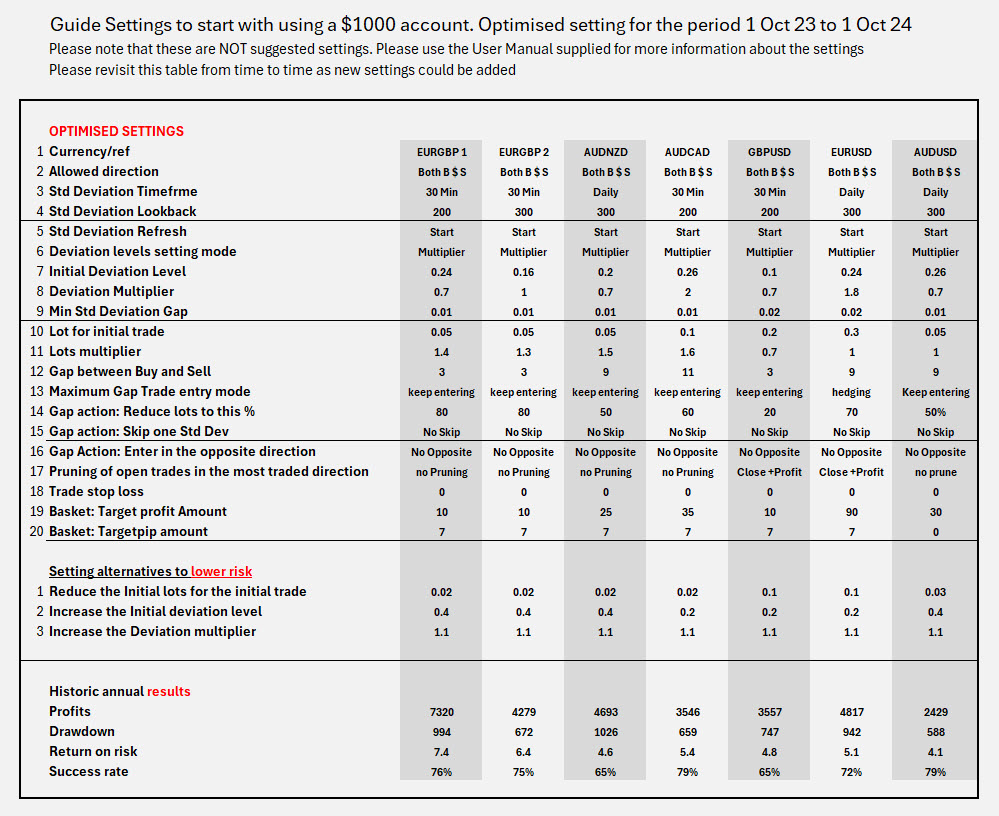

OPTIMISED SETTINGS

Please do NOT use these optimized settings. Rather use the settings in the blue table below

The Above settings are based on 100:1 leverage. Should your leverage be lower please adjust the lots sizing and bundle target in proportion to the actual leverage used. No adjustment is required for leverage over 100:1

The above settings are not proven in actual trading as the Robot has only recently been created. We suggest a demo trading period on 2 to 3 weeks to make sure you are experiencing satisfactory results

For more details about the above results please use this link: OPTIMISED SETTINGS

BELL TRADER

Setting Tips and Tricks.

These are initial guides for you to start trading the BELL trader. Once you have experienced success trading conservatively you can increase your risk.

-

Optimized settings are generally not consistently reliable (Grey Table). It is suggested that when starting out that you use the the settings based on actual trading history (Blue Table).

-

When planning your deviation levels try to make sure that there are not more than 10 open trades when the price potentially reaches the 3rd Deviation level. If your first deviation level is 0.25 and you increase each level by 0.25 you will have (3 divided by 0.25) 12 open trades at deviation level 3 which is a little too many. If your first deviation level is .3 then you will have 10 open trades at level 3 which is OK. See the video above in the Orange section.

-

Bad lot sizing can blow your account. Make sure you do not have more than 1 lot in total when the price potentially reaches deviation level 3. If you have 10 open trades of 0.1 lots each, the total open lots will be 1.0 which is OK

-

When starting your trading try to make sure that the price is not more than 2 deviation lines from the average line. This can be assessed after entering your settings and viewing the chart. If is is more than 2 deviation lines away rather wait until it is or select another strategy.

-

It is possible for open transactions to get stuck in a range where nothing much happens for a while. Consider trading 3 to 5 currencies that do not have a exposure to one particular currency to avoid this.

-

The Multiplier setting for lot sizing can be dangerous. Use it to manage your financial exposure. Use it conservatively at first (Setting of 1)

-

The multiplier setting for the Deviation levels can reduce your risk as fewer deviation levels can result by the time the 3rd deviation level is reached if the setting is above 1. Keep it at 1 at the start and increase the setting if you need to reduce risk

-

The bigger your Standard Deviation Channel period (Number of days as determined by the timeframe selected and look back period) the more stable and robust the trading will be and more likely trading will be contained by the 3rd Deviation. Consider this when using short term strategies.

-

Remember to demo trade ANY settings or strategies for 2 to 3 week to make sure you are experiencing expected results.

World Class Support

Support is provided in many ways.

-

Comprehensive User Manual. When downloading the Robot from the EAFactory Website you are also able to download a comprehensive User Manual. Owners can also download the user manual from the EA download page.

-

Comprehensive Knowledge base: Your access to your account on the EAfactory website will provide you with access to a comprehensive Knowledge base about technical trading aspects. Owners can access the Knowledge using this link: KNOWLEDGE BASE (You will have to be logged into your EAFactory account to use the link)

-

Technical Email Support: International Email support is provided with turn around times that vary from 1 hour to 18 hours depending on the time zones involved. Use the your download email to access technical support.

-

Owners Forum: Our Free trading forum has a owners forum for trading discussions and access to trading support. Use this link to access this forum: FREE FORUM OWNERS FORUM

-

Administrative support. Please use the "Contact Us" facility on this page for administrative support. CONTACT US

-

Videos are created to show aspects of trading the Expert4x Hedged EA from time to time. Please access the YouTube Expert4x Hedged Playlist at this link: YOUTUBE VIDEOS

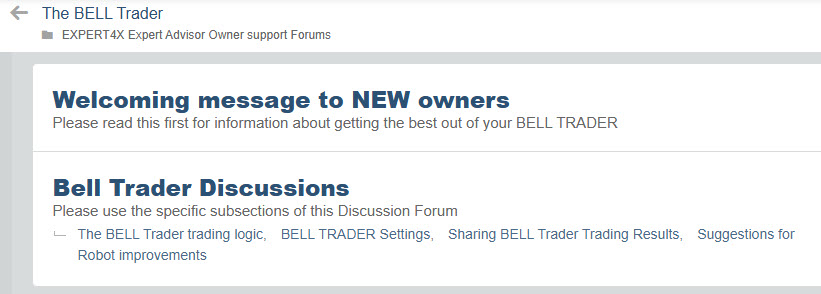

OWNERS FORUM

There is an Owners Forum in our FREE Trading Forum at this link: BELL FORUM.

You may need to join the Free forum to access the Bell Forum. Please use this link to join: JOIN FREE FORUM

CURRENCY SELECTION

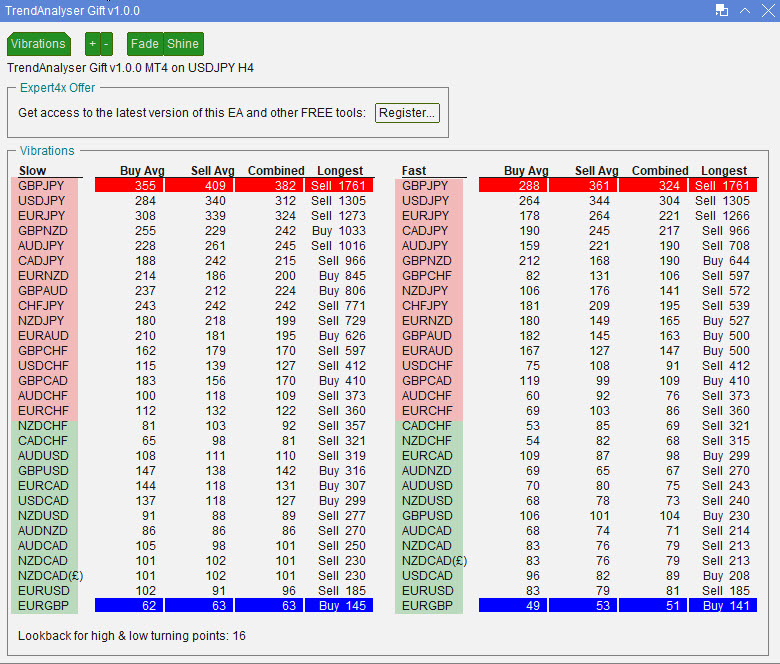

IMPORTANT: This Trading Robot is a Sideways trading Robot. It likes sideways markets and trending Markets can be very damaging. The table to the right shows currencies to avoid (Red), and currencies best traded by this Trading Robot (Green).

The Trend Analyser is a FREE tool that is downloadable from this link:-

FREE DOWNLOAD

Testing the BELL Trader for settings

VIDEO BOOKMARKS

00:00 Introduction

00:25 Video content

01:03 3 strategies

03:06 The Bell Trading Strategy

07:22 The Rubber Band Strategy

09:28 Example of Rubber Band Trading

11:02 The Standard Deviation Channel strategy

13:30 Why this strategy makes money

16:56 Channel indicator

18:04 GBPJPY Example

19:46 The Settings

28:14 Million Dollar RESULTS

29:25 The 1 week testing period

29:35 Close

See 1 Million Dollar results

Learn How to Create Standard Deviation Channels

VIDEO BOOKMARKS

00:00 Introduction to creating Stand. Deviation Charts

00:31 Direction does not matter

01:00 The Standard Deviation indicator

01:58 The BELL Standard Deviation

04:44 The start - a blank chart

06:07 Adding channels one by one

08:49 Saving the template

12:53 Automation Plans

14:47 Close

First introduction of the Channel trading concept

CHAPTERS IN THIS VIDEO

00:00 Introduction

00:47 Works on any trading instrument

01:08 Standard Deviation Channels

02:04 Finding the SAFE range to trade

04:00 Trading between Standard deviation lines

06:33 2 Standard Deviation Channel strategies

06:52 The probability BELL

07:53 The Trading method

10:41 Stacking the odds in your favour

12:48 More information to trade safely

16:31 Close

Creating Million Dollar settings

Video Book Marks

00:00 Introduction

00:48 Testing the Million Dollar Bell Trader

00:59 Finding Robot trading settings video

01:59 Activities for this video

04:26 Objectives for this video

05:10 Overview of the Bell Trader

07:40 Setting up the MT4 strategy tester

11:11 The Bell trader settings and template

16:41 Starting the first optimisation run

19:44 First Optimization results

21:49 Downloading results into Excel

23:43 Find low drawdown high-income results

26:04 Settings for a $ 10,000 account

31:18 Saving the settings

33:45 Creating settings for a $1000 account

37:06 Plans for the next video

Each purchase of the Bell Trader EA entitles the owner to trade the Robot as often as they want as long as no more than 2 computers are used at the same time.

Moving the Robot from computer to computer is easy. Simply delete it from one of your 2 computers and add it to a third.

More licenses can be purchased from the EAFactory website for approximately a 3rd of the original cost.

*** UNLIMITED USE ON ANY 2 COMPUTERS ***

The Bell Trader EA has not been specifically designed or tested for Proprietary Trading. It would take considerable personal experience to design a Proprietary Trading strategy that uses the Bell Trader Robot.

At this stage Proprietary Trading is the responsibility of the traders and Expert4x can only offer very basic support is this area.

How do I purchase the

BELL TRADER EA?

-

When purchasing you get access to both the MT4 and MT5 versions of the Bell Trader Robot

-

When purchasing you get access to both the US Compatible version and the Standard version of the Bell Trader Robot

-

We have different pricing options depending on your status as an Expert4x client or Premium Forum member. Please review these to see which option applies to you.

-

Purchases are payable using PayPal. Should you not be able to to use PayPal we can offer you a Crypto alternative at the same price. Please contact us for more information

-

Please read the welcoming message in the free forum to get the fast start on getting the best out of the BELL Trader

-

Please read the Sales conditions and Risk Disclaimer at the bottom of this page

IMPORTANT: We do NOT offer Refunds. Before you purchase, please read our "Sales Agreement" and "Risk Disclaimer" at the bottom of the page. By Clicking on any of the PayPal Buttons, you are agreeing to the "Sales Agreement".

New Clients $1000

Please use the PayPal Button on the right